Beyond Wage Savings—The CFO’s Real ROI Framework

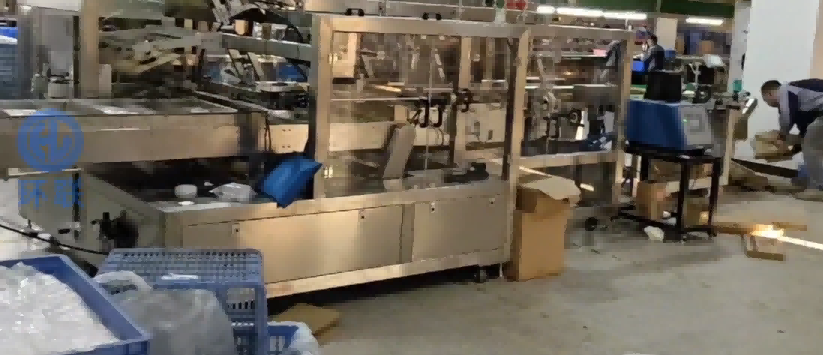

For CFOs,the decision to invest in Packaging Automation is a capital expenditure that demands a clear, data-driven Return on Investment (ROI) calculation. However, many financial models make the costly mistake of focusing solely on labor cost reduction. While saving on wages is a benefit, the true financial impact of Packaging Automation lies in eliminating the hidden costs of manual operations—costs like employee turnover, material waste, production bottlenecks, and safety risks. This guide delivers a clear, data-driven framework to quantify the true cost of Packaging Automation and generate accurate, actionable ROI calculations.

4 Hidden Costs of Manual Packaging (CFOs Miss These)

| Hidden Cost | Key Financial Impact | UBL Automation Fix |

|---|---|---|

| Turnover | 30% turnover = $120k/year replacement

costs (for 3 $40k/year workers)[1] |

Replaces 3-5 roles; cuts turnover by 40% |

| Errors |

5% material waste = $80k/year (80k units/month) |

99.9% accuracy; eliminates waste |

| Bottlenecks | Peak overtime = $20k/month | 24/7 throughput; no overtime |

| Safety/Fines | Workers’ compensation claims and potential

regulatory fines[2] |

80% fewer injuries; full compliance |

CFO Exclusive Model: Calculating the ROI of Packaging Automation

The true ROI calculation must factor in the elimination of these hidden costs.

At a U.S.–based FMCG facility, an investment of $80,000 in a UBL fully automatic cartoning machine delivered substantial financial gains within the first year.

| Financial Component | Annual Value | Source of Savings |

|---|---|---|

| Labor Savings | $148,680 | Elimination of manual roles and reduced turnover. |

| Material Reduction | $20,000 | 99.9% accuracy in material handling. |

| Quality Improvement | $30,000 | Fewer defects and product recalls. |

| Total Annual Savings | $198,680 | – |

| Annual Operating Cost | $4,000 | Energy and routine maintenance. |

| Net Annual Savings | $194,680 | – |

| Initial Investment | $80,000 | UBL Cartoning Machine Cost. |

Actionable Next Step: Request Your Customized ROI Model

[Click Here to Request Your Customized ROI Calculation and Financial Analysis]

References

[1]:Occupational employment and wage statistics released by the U.S. Bureau of Labor Statistics (BLS). For specific

(https://www.bls.gov/oes/2023/may/oes519111.htm)

[2]:OSHA Penalties. Occupational Safety and Health Administration (OSHA).

(http://www.osha.gov/penalties)

3 回复