📦 Market Size: Growth Potential from Billions to Hundreds of Billions

The global packaging automation market has already reached the multi-billion-dollar scale and is poised for sustained growth:

Industry Trends: Automation, Intelligence, and Sustainable Design Shape the Future

Automation Upgrades Drive Efficiency Gains

E-commerce and Logistics Fuel Packaging Innovation

AI, IoT, and Smart Manufacturing Trends

Significant Regional Growth Disparities

Key Growth Drivers Behind the B2B Packaging Boom

Efficiency, Cost Control, and Labor Optimization

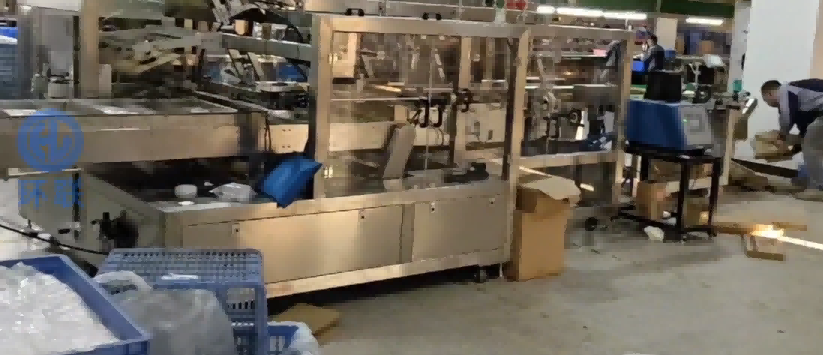

Automated packaging systems allow manufacturers to increase throughput while reducing labor dependency. Machines operate continuously with minimal variation, improving Overall Equipment Effectiveness (OEE) and reducing costly downtime and human error.

In high-volume packaging environments, automation delivers consistent quality and significantly lowers long-term operating costs.

Sustainability and Material Efficiency

Sustainability is no longer optional. Governments, brands, and consumers are demanding reduced packaging waste and improved recyclability.

Automated packaging systems help manufacturers:

-

Optimize material usage

-

Reduce scrap rates

-

Handle recyclable and biodegradable materials more precisely

As a result, automation supports both environmental goals and cost efficiency【5】.

Food & Pharmaceutical Compliance Requirements

Food, beverage, and pharmaceutical industries impose strict requirements on hygiene, traceability, and tamper evidence. Automated packaging systems provide controlled, repeatable processes that ensure compliance with regulatory standards.

Industry data shows that:

-

The food industry accounted for over 28% of packaging automation revenue in 2024

-

The pharmaceutical sector is expected to grow at nearly 12% CAGR through 2030【7】

Industry Challenges: Investment and Skills Transition

Despite strong growth, the industry faces two major challenges:

High Initial Capital Investment

Advanced automated packaging lines—especially those incorporating robotics, AI, and IoT—require significant upfront investment. This can be a barrier for small and mid-sized manufacturers.

To address this, some companies are adopting flexible models such as Robotics-as-a-Service (RaaS) or modular automation upgrades.

Workforce Skill Transformation

While automation reduces reliance on manual labor, it increases demand for technicians skilled in machine operation, programming, and maintenance. Training and upskilling are becoming essential components of successful automation strategies.

A New Era for B2B Packaging

The B2B packaging industry is entering a new era defined by automation, intelligence, and sustainability. Whether supporting high-mix production, peak-season e-commerce demand, or strict regulatory environments, automated packaging solutions are becoming a strategic necessity rather than a competitive advantage.

As AI, IoT, robotics, and data analytics continue to converge, packaging systems will play an increasingly central role in smart manufacturing ecosystems. Companies that invest early and strategically in automation will be best positioned to compete in the global market.

Data Sources & References

【1】Fortune Business Insights – Packaging Automation Market

【2】Precedence Research – Packaging Automation Market Size & Forecast

【3】Industry Intelligence Institute (IIM) – Global Packaging Automation Market Outlook

【4】Global Market Insights – Packaging Machinery Market Analysis

【5】GlobeNewswire – Packaging Automation Market Driven by Robotics & AI

【6】GlobeNewswire – Packaging 4.0 Market Trends

【7】Mordor Intelligence – Packaging Automation Market Industry Report

一个回复

I appreciate how the article highlights the importance of automation in the packaging sector. With automation boosting speed and reducing human error, it’ll be interesting to see how packaging companies will tackle the sustainability challenge alongside technological advancements.